Was this email forwarded to you? Sign up here

Fintech is evolving rapidly. Lets take a look at some insights from the 113 page report from Fintech Brainfood

As we look to 2025, the fintech industry is evolving rapidly, fueled by new trends, technological advancements, and shifting consumer behavior. The “State of Fintech 2025” report highlights several game-changing developments poised to impact the financial services, crypto, and wealth management industries. Here are the most notable insights and their implications:

1. The Age of Fintech Hyperscalers

We’re witnessing the rise of fintech hyperscalers like Nubank (110M+ customers), Klarna (85M customers), and Revolut (50M customers), proving that fintechs are now rivaling traditional banks. Their ability to scale across geographies and products signifies a competitive landscape where customer acquisition and bundling services are key.

Impact: Wealth managers must innovate their client offerings to compete with these fintech giants, who combine credit, banking, and investing into seamless, user-friendly platforms.

2. AI Integration: Cost Savings and Capital Markets Innovation

AI is disrupting finance at every level. Klarna’s chatbot now handles two-thirds of its customer service workload, performing the work of 700 agents. Meanwhile, capital markets are leveraging AI to process unstructured data and automate equity and credit analysis.

Impact: In wealth management, AI-driven tools will automate portfolio optimization and streamline client communication, freeing advisors to focus on strategy and relationships.

3. Stablecoins and Real-World Applications

Stablecoins are becoming mainstream payment rails. With Stripe acquiring Bridge for $1.1 billion and Visa launching tokenized platforms, stablecoins are now bridging international trade and real-world asset transfers. Use cases in the global south illustrate near-instant cross-border payments replacing legacy systems like SWIFT.

Impact: Crypto adoption will accelerate in traditional financial services as stablecoins unlock speed, lower costs, and treasury efficiencies. Wealth managers must prepare for this as part of a modern client portfolio.

4. Embedded Finance: $320B Opportunity

Embedded finance remains fintech’s fastest-growing sector, projected to reach $320B by 2030. Platforms seamlessly integrating financial tools—like payments, lending, and insurance—will drive financial inclusivity and new revenue opportunities.

Impact: Wealth management firms should explore embedded solutions that integrate tax, insurance, and financial planning into a unified client experience.

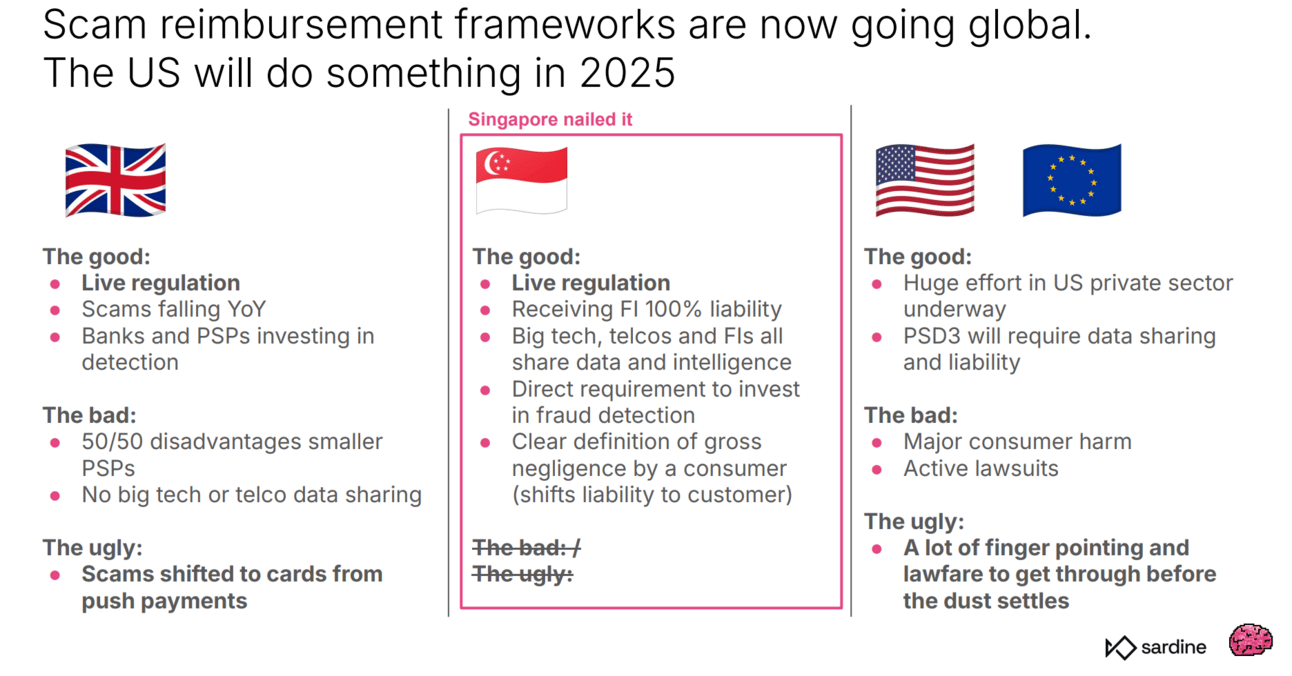

5. Scamdemic: The New Industry Challenge

Fraud is escalating globally, with $1.03 trillion lost in scams in 2023. The rise of deepfakes in identity verification, particularly in high-risk markets like Brazil, has forced regulators to act.

Impact: Wealth managers and financial firms must invest heavily in AI-powered fraud detection tools to protect client assets and maintain trust.

Looking Ahead

Fintech is at the forefront of innovation, reshaping the financial landscape with AI, embedded finance, and crypto solutions. For financial professionals, adapting to these trends is no longer optional—it’s imperative to remain competitive, efficient, and trusted in an increasingly digital world.

Beat Black Friday with BILL

Get the deal of the year for you and your business when you choose the BILL Divvy Card + expense management software, AND an exclusive gift when you take a demo. Move over, Black Friday.

Choose BILL Spend & Expense to help your business:

Reap rewards with reliable cash back rates

Create virtual cards that help protect from fraud & overspending

Control spending with customizable budget controls

Take a demo by the end of the month and take home a Nintendo Switch, Apple AirPods Pro, Samsung 50" TV, or Xbox Series S—your choice1.