Was this email forwarded to you? Sign up here

2021 saw the Boom & Bust. Prediction markets are taking us back.

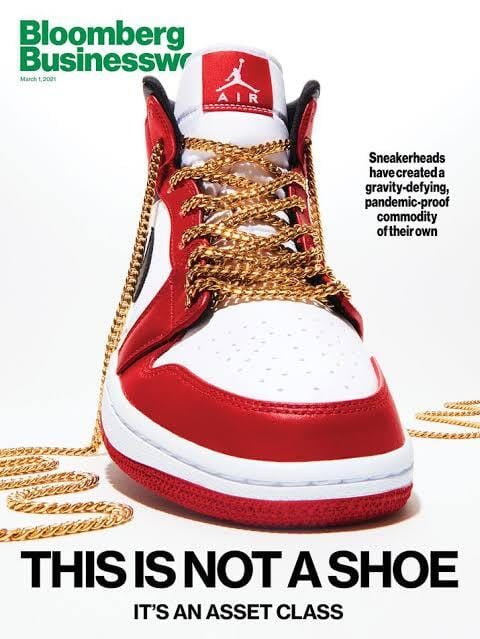

Bloomberg put out a magazine cover in 2021 that had the headline “It’s not a sneaker it’s an asset class!”

$NKE ( ▲ 1.59% ) at the time was booming. Every sneaker on their SNKRS app sold out and then StockX, GOAT, $EBAY ( ▲ 1.17% ) and dozens of other second hand sites were selling the sneakers for anywhere from 2x-20x the price. Then the bust happened. Sneakers, collectibles, Pokémon, trading cards and everything in between came down to earth. Maybe it was covid, maybe it was stimulus, maybe low interest rates- whatever it was it ended.

Now Kalshi the prediction markets platform has partnered with StockX to bring us back. Predictions on everything from sneaker prices to Labubu dolls to collectibles. It’s clear to see that Polymarket is likely going to offer the same. Does $HOOD ( ▲ 2.24% ) add this to their app alongside sports and economic prediction contracts?

Neustreet & Pricing Culture were two early data companies in the collectibles space and you would think the value of their data just sky rocketed with this new use case and need. Some times for startups and companies it’s about survival. For data companies it’s always been true that the value of their data goes up once you have years of history. Now that prediction markets are coming for collectibles it will be interesting to see who the winners are. StockX is great, but it’s one platform and doesn’t give you a true view of the world and price of collectibles. You would think a better partner is someone aggregating across marketplaces.

One thing is clear- prediction markets need data. They need to keep innovating and they want to find more users. Collectors & Sneakerheads are a great way to bring in more users and get the excitement of collecting back.

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.