Was this email forwarded to you? Sign up here

DaaS companies are under the microscope. Are they defensible?

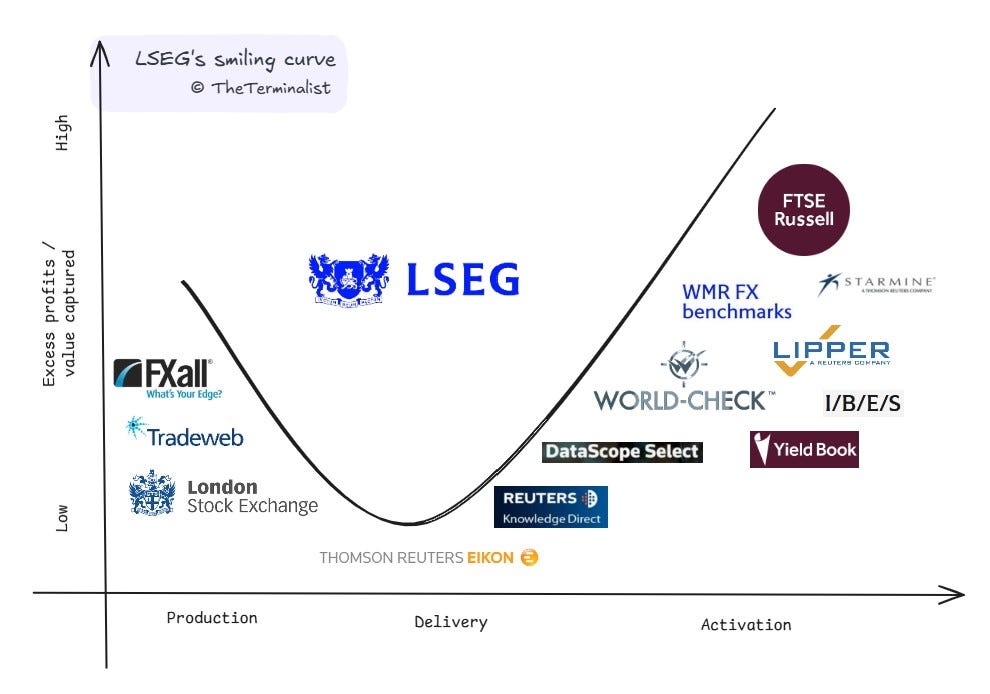

As I think deeper on the topic I wrote briefly about on my Linkedin post that now has gotten over 150k impressions, Is Factset Disruptable? We think about Production, Distribution, Activation and how this relates to our current and future portfolio companies. This topic was well outlined in a post from The Terminalist and captures a lot of what my partner Howard & I think about when investing in this part of the Fintech Ecosystem.

Stocktwits a company Howard founded and both him & I are very active in, is in a unique spot as they sit in the Production area of the smiling curve. With a rich data asset of 17 years of historical discussions around Stocks, Crypto, & Commodities, the Stocktwits data asset is not only tagged to tickers via the $Cashtag$, it has polling data, sentiment, and so much more. This data asset gives Stocktwits a unique moat and is now driving the ability for Stocktwits to also sit within the Activation section of the curve. With multiple indices being built and soon to launch in 2025, the opportunity to create unique indices based on Trends, Trends with no Friends, The Degenerate Economy, trending sectors, and sentiment is tremendous. The Terminalist argues the Production & Activation areas have the best multiples and the largest opportunities to grow revenue margins, and we are excited about where Stocktwits is positioned for the future.

Another exciting company in our Fund IV portfolio that we are bullish on is Finchat.io

When we invested in Finchat, they quietly built for years under the brand Stratosphere. Not only did the founders have a beautiful UI/UX, but they had a strong data asset that they had been creating of KPI's and Segments for US public stocks. Combining their unique data asset with best-in-class partner data assets under a rich AI copilot and arguably one of the nicest UI/UX toolsets for investors, Finchat.io has set itself up to sit in the Production and Distribution part of the Smile. As they continue to create more data assets, their opportunity to expand into Activation and play in all areas of the smile curve is what makes us particularly excited. With a lean team, they have been shipping new features at unbelievable speed.

Similar to Bloomberg, LSEG which acquired Reuters, has been sitting at all ends of the smiling curve with multiple acquisitions over the years. The below-smiling curve shows some of their assets and additional players in the Fintech ecosystem. As Finchat expands its offering & grows it looks to sit squarely across all these areas.

There are many other portfolio companies currently in the portfolio or from the past that we have exited including YCharts, ChartIQ, Koyfin, Pricing Culture, StreentContext and more. 11th Estate is another Social Leverage Fund IV company that currently attacks a unique opportunity around Securities Class Action Claims. Similar to companies like ISS and FRT, 11th Estate is helping investors collect the money they are owed due to securities class action and fair funds cases. What makes 11th Estate unique is they have a vast dataset of global cases not only for securities class actions, fair funds, but also for collecting case information for consumer claims. They are structuring this dataset and have been building their own unique data moat for the last few years similar to Production companies. What makes 11th Estate compelling is they have the opportunity to create Risk Scores and case Scores as well as create indices which will eventually land them in the Activation bucket. For now, they are focused on the technology to process the Production data asset they have created and building these unique workflows not only for institutions like wealth managers and financial institutions but also directly to retail via consumers connecting their brokerage. In the future 11th Estate will occupy multiple areas of the smile curve and will be a company to watch over the next few years.

The takeaway we see when reading this post is that AI is making data creation, cleaning, and gathering 100x more efficient and the days of having to have 10s of thousands offshore are no longer. We hear frequently "When will we have the first $1B company with 1 person because of AI?" And we think about the efficiencies that AI creates and maybe it won't be a 1 person company, but we are sure that you won't need 10s of thousands of bodies offshore to compete. Owning the data moat, creating unique data assets via Activation like indices and ratings, and having lower cost capabilities for delivery is what continues to excite us as we invest in the ecosystem. There are lots of unique and niche data assets and for those smart and creative enough to acquire and create these companies, the sky is the limit. Data & information services companies have historically been roll-ups of lots of small companies and have taken years to blossom. We continue to believe there are opportunities to acquire a lot of unique data assets, but with the technology boom we are seeing, running these businesses with a smaller footprint is very achievable.

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.