The Initial Data Offering (IDO) community is a place for data enthusiasts to discover new datasets daily.

The mission is to build a community of data enthusiasts and curate high-quality, unique datasets for businesses, researchers, and organizations worldwide.

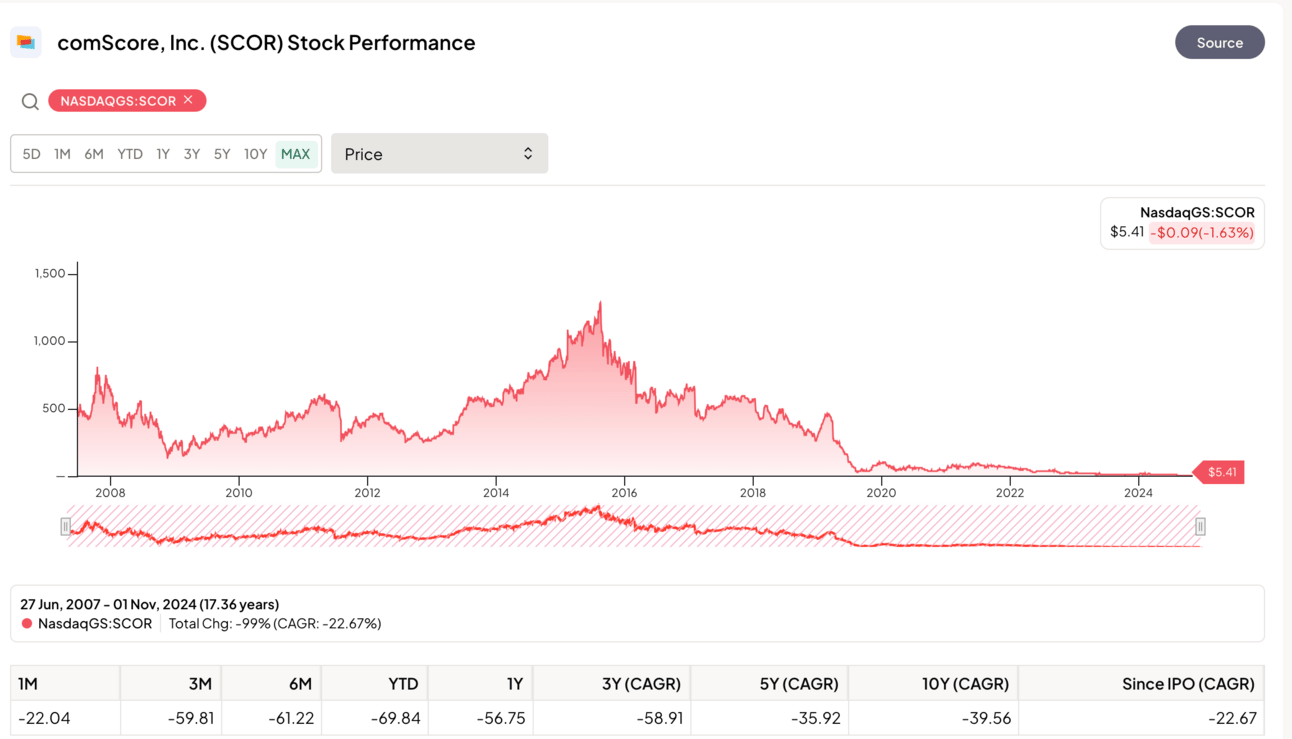

Why is Comscore a public company with a market cap of only $26m?????

For my public market research, my first move is to go to Finchat.io and talk to the AI Copilot. What is the main business of Comscore? According to Finchat:

Comscore, Inc. offers a variety of products and services primarily focused on measuring advertising, consumer behavior, and audiences across different media platforms. Here are the main products and services provided by Comscore:

Ratings and Planning Products and Services:

Media Metrix Multi-Platform and Mobile Metrix: Measures websites and apps on computers, smartphones, and tablets.

Video Metrix: Delivers measurement of digital video consumption.

Plan Metrix: Offers understanding of consumer lifestyle.

TV Essentials: Combines TV viewing information with marketing segmentation and consumer databases.

StationView Essentials: Helps understand consumer viewing patterns and characteristics.

Cross-Platform Solutions:

Comscore Campaign Ratings: Verifies mobile and desktop video campaigns.

OnDemand Essentials: Provides transactional tracking and reporting.

Validated Campaign Essentials: Validates digital ad impressions, identifies fraudulent ones, and verifies ads are shown in brand-safe content and delivered to the right audience targets.

Total Home Panel Suite: Captures OTT, connected TV, and IoT device usage and content consumption.

Analytics and Optimization Products and Services:

Provides solutions for planning, optimization, and evaluation of advertising campaigns and brand protection.

Movies Reporting and Analytics Products and Services:

Measures movie viewership and box office results by capturing movie ticket sales in real-time or near real-time.

These products and services cater to digital publishers, television networks, movie studios, content owners, brand advertisers, agencies, and technology providers.

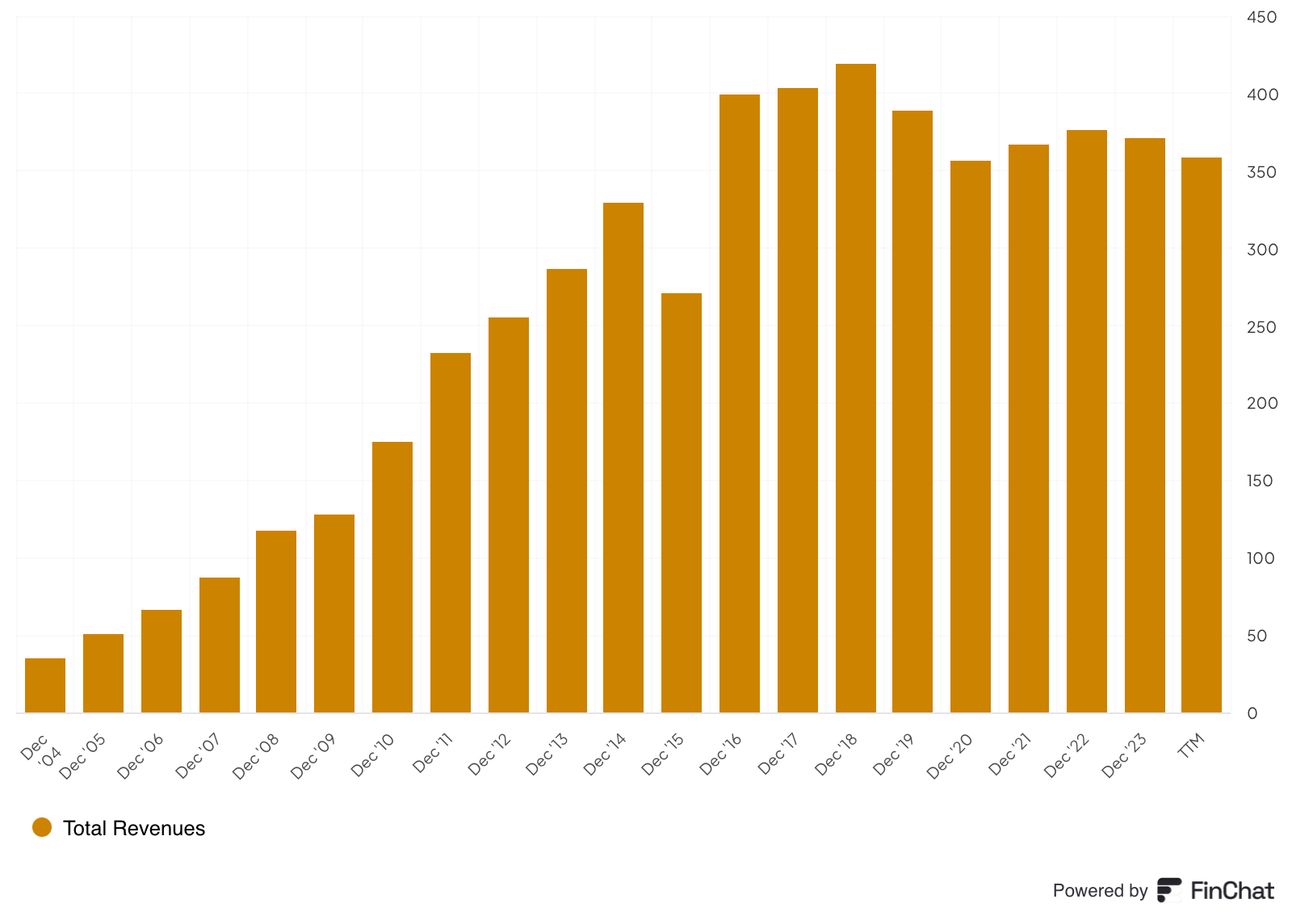

I look at this product mix and I think, hmmm, this is a data powerhouse. I know in the financial services space, Comscore has always been a dataset hedge funds have been interested in. Comscore as a company had $370m in revenue in 2023.

The chart below says it all, Comscore is struggling….

Why are they public? Why hasn’t someone acquired them like a SimilarWeb or anyone who wants to own their rich data assets? I have more homework to do to better understand the history, but repositioning the data assets seems like a no-brainer. I asked Finchat, why has the company been struggling and it does a good job of getting me up to speed:

Based on the latest earnings call transcript and financial metrics, here are the key reasons for Comscore's financial struggles:

Pressure on Legacy Media Clients:

Slower-than-Expected Growth in New Products:

The pace of scaling their CCR (cross-platform ad campaign measurement) product has been slower than expected, delaying the revenue growth needed to offset the impact of weakness in their traditional media clients ([source]).

Softness in Custom Offerings:

There has been a decline in revenue from their more bespoke custom offerings due to a pullback in discretionary ad spend from certain clients ([source]).

Impact of Oracle's Ad Business Shutdown:

Oracle's announcement to shut down their ad business negatively impacted Comscore's Proximic revenue ([source]).

Declining Revenue:

Macroeconomic Challenges:

The broader industry and macroeconomic environment have created unpredictable demand for custom digital products ([source]).

Revised Revenue Guidance:

The company has revised its full-year 2024 guidance, now expecting revenue between $350-$360 million and an adjusted EBITDA margin of at least 10% ([source]).

Financial Metrics:

Net Income:

Comscore has consistently reported negative net income over the years, with a net loss of $79.36 million for the fiscal year ending 2023 ([source]).

EBITDA:

The EBITDA has shown some improvement, with a value of $21.51 million for the fiscal year ending 2023, but the overall trend over the past decade has been negative ([source]).

In summary, Comscore's financial struggles are due to a combination of challenges in its legacy business, slower growth in new products, softness in custom offerings, and broader macroeconomic factors.

With all the struggles, I think Comscore is an interesting company. This analysis would have taken me a ton of time, but with Finchat.io I can get a good picture of the company in just a few minutes. Keen to see where Comscore ends up in the next 24 months.

Get your news where Silicon Valley gets its news 📰

The best investors need the information that matters, fast.

That’s why a lot of them (including investors from a16z, Bessemer, Founders Fund, and Sequoia) trust this free newsletter.

It’s a five minute-read every morning, and it gives readers the information they need ASAP so they can spend less time scrolling and more time doing.