Was this email forwarded to you? Sign up here

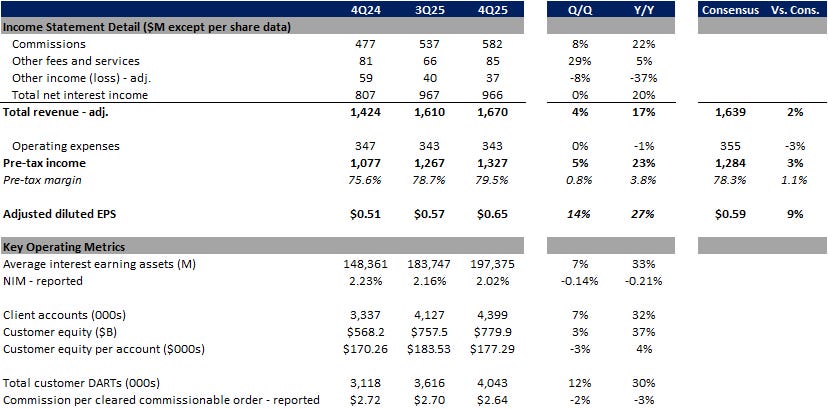

We just got some insights. Interactive Brokers reported….

$IBKR ( ▼ 0.52% ) reported, and I thought the prediction markets insight was particularly interesting. If you don’t follow The Diversified Analyst, it’s a good way to keep up with all the public brokerages and exchanges.

This, in particular, is interesting:

Prediction markets - Traded 286M pairs in 4Q, up from 15M pairs in 3Q and now has 4 members quoting into the exchange and over 10k listed instruments. While ForecastEx offers sports contracts, IBKR’s client base does not rely on sports. IBKR believes prediction market contracts will have enormous applicability to many in the future. Currently, the most actively traded contracts on IBKR are weather and temperature contracts. IBKR is working on tying these weather contracts in with electricity and natural gas contracts. In terms of onboarding institutional clients to the prediction market, it is more a matter of selling the product rather than a question of product design

I did some work on trading weather futures when I worked at WorldQuant many years ago, and we used all types of weather forecasts and historical weather data. That was 10 plus years ago, and I am sure the quants now see the same opportunity to trade weather prediction markets.

The big eye opener for me was the ramp from Q3 to Q4 in traded pairs, along with the 10,000 instruments they now support. I can only imagine we see some explosive numbers for $HOOD ( ▼ 1.75% ) at earnings which are around the corner.

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.